Hello from the SFO Polaris lounge! I’m flying to Japan in ANA First Class tonight thanks to wide-open award space that happened earlier this year. At SFO, the lounges all close by 10 pm (Centurion at 9 pm, KLM at 7:45 pm), but the flight is at 1:45 am, so ANA issues $30 meal vouchers per passenger in the form of a Mastercard Gift Card. Terms state the merchant must be categorized as “food, dining, or restaurant.” It’s the same GC that United, Alaska, and Delta issue (though I hear they are sometimes Discover cards), with the same zip code of 60173. You receive a QR code and the card number, expiration date, CVV, and billing zip code. From some internet sleuthing, I found the entire billing address: 1475 E Woodfield Rd, Schaumburg, IL 60173.

TagUnited

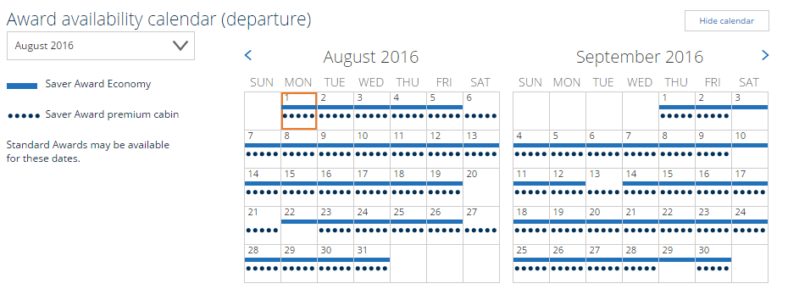

The new UI that they rolled out sometime last year looks like this:

Days with only Economy availability were yellow, days with only Premium economy were Blue, and days with both were green.

I was searching for award space today and got this:

Days with Economy availability have a solid line through it, and days with Premium availability have a dashed line through it. I’m not entirely sure how I feel about the changes, maybe it is easier to view the specific availability that you want, maybe it isn’t.

I actually noticed some changes yesterday too, where they were playing around slightly with the color scheme, with grey instead of white for no availability, but was similar to the old UI. I don’t have a screenshot though.

I would probably expect further tweaks in the coming weeks!

With that out of the way, onto the main event…

I f***ing love Delta Skymiles

Okay, maybe that’s a bit of an overstatement, but it isn’t that far off.

Being good at anything, be it a job or a hobby, is all about having a set of tools that you know inside and out. As a software engineer, it matters less how many programming languages I know so much as having a set that covers a sufficiently diverse functionality and knowing that set very well.

Travel hacking — and for the purposes of discussion, I’m going to limit the scope of discussion to redeeming airline miles — is no different. As great as it is to know the ins and outs of 20 different programs, fragmentation (i.e. maintaining balances across all those programs) is expensive both mentally (you have to remember what program is good for what redemptions) and financially (since you’re likely to have orphan balances). That is to say, having a few programs that you accrue balances in and making active choices to invest in those programs is far more beneficial for the average person than a shotgun approach.

I’ll use myself as an example. Although I have access to pretty much every frequent flyer program on the planet (through transferrable currencies like Chase Ultimate Rewards, American Express Membership Rewards, and Starwood Preferred Guest), and although I know some international programs have some really nice redemption opportunities, I generally stick to the following six: Alaska, United, Air Canada, Virgin America, Southwest, and you guessed it, Delta.

Admittedly, six is still a lot, but the choice of those six were very intentional:

- Alaska has great slate of partners (most of OneWorld) and very flexible routing rules.

- United doesn’t charge fuel surcharges and is a member of the Star Alliance.

- Air Canada offers cheaper business class redemptions on Star Alliance partners relative to United.

- Virgin America flies SFO-JFK and is a fixed-value currency.

- Southwest is price-competitive on random short flights, also has a fixed-value rewards program, and all awards are fully refundable.

- Delta Skymiles are a fixed(ish) value currency.

This is nominally a post about Delta, so let’s talk about it. Why are Delta Skymiles in my Swiss-army knife of airline miles, and why do I like them so much?

For starters, they transfer from Membership Rewards, so I have very easy access to them. But more importantly, you can pretty much always book an award flight on any route Delta flies. This is made possible by the fact that they have five different levels of award pricing for each route, and although it’s primarily a ploy to reduce the value of your miles (to closer to 1 cent a piece on Economy class redemptions), I actually appreciate the opportunity to be given a choice whether to use miles or points irrespective of the cash price. I can always decide that the “value” is too low, but that’s a decision for me, not for the airline.

To be clear, it annoys me to no end that they got rid of their award chart, and I find it insulting. Restricting access to information is one of the most in-your-face power plays you can make. But consider the purpose the Skymiles serve for me. If I’m flying somewhere domestically (for which United and Alaska typically offer poor redemptions, if there’s even availability) in Economy, and neither Southwest nor Virgin America fly to my chosen destination, I can always fall back to flying Delta, since I know that there will be availability. My redemption value (cents per point) might be something like 1.2, but if you consider the fact that it costs me between 0.3 and 0.5 cents to earn a single Skymile (via Membership Rewards), that’s pretty much a no-brainer versus paying cash (this is separate from the argument of whether to use a cash back card or a points-earning card because we’re talking about redemption, not accrual).

Moreover, I’ve found Skymiles to be the most consistently useful currency for my parents, who fly mostly domestically out of New York and (almost) always together. Delta covers most of the map, and if their cash prices out of New York are competitive (which they almost always are), then I can pretty reliably save them money by using Skymiles, not to mention the fact that the multiple tiers of awards makes it far more likely that there is award space available for two. Given that my dad basically wants to avoid paying cash (i.e. retail price) at all costs, Delta offers me an unbeatable value proposition.

Diversify, and always explore.

The only reason I am able to speak this positively about Delta is that I never bet the house on them. I didn’t pour all my loyalty into its arms (whether miles or status), and as a result, I was well positioned to adapt to the changes in their loyalty program. This is true of every program in my toolkit. I keep as many points as possible in transferrable currencies, and when changes do occur (inside or outside my toolkit), I constantly re-evaluate the role the program in question can play in my overall strategy.

It also pays to re-evaluate your strategies even in absence of program changes. For example, my parents recently got a Chase Sapphire Preferred card, which gives them access to 1.25 cent per point redemptions on flights through the Chase portal. Although historically they’ve put their spending on the U.S. Bank Flexperks card (between 1.3 cents and 2.0 cents per point) at 1 point per dollar, if they instead put their daily spending on the Chase Freedom Unlimited card (1.5 points per dollar), they can both take advantage of Chase Ultimate Rewards transfers when beneficial or get a guaranteed 1.875 cents per point on their spending (1.5 * 1.25) when redeeming for flights (I actually like this strategy better than a 2% cash back card, although the 2% card is strictly better than the FlexPerks strategy).

That’s me, what about you?

The original idea for the post was to talk about the strategy of combining refundable awards bookings with revenue-based airlines (Southwest by default and JetBlue/Virgin America if you have status) with good last-minute award availability on more traditional chart-based programs, but this was a bit more spicy and it’s something I’ve been thinking about more and more as I scale up my miles earning to a point where my balances are hitting six and seven figures.

So what about you? What are your go-to programs? What do you use each program for?

Happy hacking!

Related Reading

And mysteriously, the award only priced at 60,000 United miles. This makes no sense at all, given that a one way Asia award should be *at least* 35,000 miles.

I tried to replicate with no success, but hey, maybe United.bomb is good for something every once in a while.

Has anyone seen anything like this?

I checked my offer, and it was for 85% bonus miles. After taxes and fees, that brought the cost to 2.03 cents per mile, which was a price I was okay with, but ultimately passed on.

However, a data point from one of my friends, Josh, as well as FlyerTalk shows that the bonus actual goes up to 100% bonus miles.

Doing the math, the price comes out to be 1.75 cents per mile before taxes and fees, and 1.88 cents per mile after fees. Not a bad deal at all, especially if you are redeeming for business class or higher!

You can check your personalized promotion by clicking this link here.

Access the old version of the Amex Offers website. American Express rolled out new version of the Amex Offers website a couple of months ago, but the new interface is much less convenient to see and add all your offers at once. Fortunately, the link to the old version of the Amex Offers website is still working! H/T Miles to Memories.

Buy United miles for as low as 2.03 cents/miles with a targeted 85% bonus for buying miles. 2.03 cents/mile is pretty good, especially if you are looking to book premium cabins on Star Alliance. You must have been targeted for the 85% bonus, and you must buy at least 30,000 miles to get that price, but you can easily check if you were targeted by clicking this link and logging in. I personally was targeted for the bonus and will likely be purchasing the minimum required to get the 2.03 cents price. H/T Travel Codex

A fare war has erupted from the San Francisco Bay Area to Hawaii after Virgin launched their new route SFO-HNL. Fly to Hawaii for as little as $398 round trip, which is a great deal to Hawaii. H/T Travel Skills

Free $15 for Chase Freedom cardholders when using Visa Checkout. $15 minimum purchase required, unlike the previous Visa Checkout offers where you could buy a $0.49 game code from Newegg. H/T Doctor of Credit

Remember SkipLagged?

Try out hidden-city ticketing yourself with ITA Matrix

© 2024 DEM Flyers

Theme by Anders Norén — Up ↑