I know better than to mess with the Devil(‘s Advocate), so I figured out a different tagline for this post than my previous one. Still pretty reminiscent, but it gets the point across…

Anyway, I tried a couple of experiments with authorized user cards in order to see if I could stretch out my paltry, 1 year 3 month average age of accounts. In particular, one experiment I tried was seeing if I could force Amex to backdate my Member Since date (not the account opening date, which was discontinued) by adding myself as an authorized user on my parents’ account and then somehow parlaying that into backdating on my cards that were opened before the rule change (hint: this failed miserably).

I also traded authorized-usership with a friend in order to qualify for increased signup bonuses on the Chase Sapphire Preferred and Marriott Premier Rewards cards.

Between my experiments and the above trade, I succeeded in doing the exact opposite of what I had set out to do: gain more points while improving the average age of accounts on my credit report. I have since closed the cards, but they were sitting on my credit reports with one and two month lifespans — not something any issuer wants to see.

After doing some research, I found an article from Experian explaining that it is possible (and legal) to ask a credit card issuer to remove cards from your report if you are no longer an authorized user, since you have no financial liability for the credit line.

Aha! A way out.

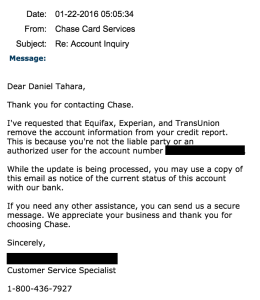

Well, sort of. For Chase, I had no problem. I simply sent a Secure Message explaining what I wanted to do (with the correct verbiage), and three days later, I received a response saying the card in question would be removed from my reports with Experian, TransUnion, and Equifax.

Unfortunately, Amex was a very different story. Two separate chat sessions (chat reps can’t help you with this sort of thing) and two phone calls (to Amex’s Credit Bureau Unit; 1-800-874-2717 for reference), I had gotten nowhere. All the reps I spoke to, including one manager, were firm in declaring that the card could not be removed from my credit reports due to reporting guidelines that require they continue to be reported for seven years. When I pressed whether this was Amex’s policy or that of the credit bureaus, I was ultimately told that it was the latter. Although this is clearly false given my experience with Chase (though to be fair, I haven’t actually dug up the legal documents to support my claim), it’s a fool’s errand to try to convince a bank to bend their rules, so ultimately I gave up.

Regardless, one of two ain’t bad, and I did manage to undo some of the damage to my credit report in the process.

Did you know you can have (closed) authorized user cards removed from your credit report? If so, have you had success with other banks?

Cheers from Dublin!

[…] Did You Know? You Can Have Authorized User Cards Removed from Your Credit Report – If an authorized user account is affecting your score, then you may be able to get the account removed from your report some of the time. […]

Seems like the easiest way to get the accounts removed is to dispute them directly with the credit bureaus telling them you are no longer an authorized user and have no financial liability. Don’t waste your time with the banks.

Yep, that’s the other option. Part of me is hesitant to mess with Amex though. If it were another bank, I’d give it a go. You have experience doing this?

Thanks for this. For chase, were you the AU requesting to be removed or the primary person requesting an AU be removed? I’m in the latter category. Can I send an SM with that request?

Thanks

I was a (former) AU on a card that had been reported to the credit bureau.

In the latter (your) case, you always have the ability to boot an AU off your account. For Chase, this should be possible by SM as they can do pretty much everything a phone rep can.

Good luck!

Thanks. Should I even care though? Does having an AU on my account “add up” on my credit report?

If you’re the primary cardholder, no. Unless the AU goes on a shopping spree and foots you with the bill 😉

If all you want to do is cancel the AU card, you can definitely do that. Call the card issuer, it should take them a minute to do. Why do you need the card removed from their credit profile?

[…] Did You Know? You Can Have Authorized User Cards Removed from Your Credit Report by DEM Flyers. Useful little tips here! Upcoming blog you should follow if you don’t already. […]

Great info! Would be nice to know if this works for Bofa or Citi as well. I’m an AU on most of my wife’s accts, as I do most all of the spend. Would be great to get a bunch of those removed.

If you try it out, drop us a comment with the results?

For the removal from your credit report of the reporting of the Chase accounts, how long did it take? My husband removed me as AU on 2 of his Chase cards 2 or 3 weeks ago, but I still see them when I look under New Accounts on my credit tracker. Any advice on how long it take/how you knew once it was done would be great. Thanks!

Usually it will take 1-2 billing cycles for the account to get marked as closed, but you should be able to ask that Chase remove the AU cards from your credit report immediately on closure.

Great info that I honestly didn’t know! 😉

What wordage did you use to get Chase to cancel the AU and remove it form your credit file in the SM?

No way to subscribe to replies?

Here’s what I sent:

“I was added as an authorized user to the card above. As my authorized usership has been cancelled, and I am not a liable party for the credit line, I would like to have the card removed from my credit report.”

Re: subscribing to comments — alas, no. We’ll look into some other commenting plugins to see if that possible.

Thanks! I’ve seen other blogs use Disqus. I don’t know if it’s free for blog owners or not, but it’s all I can think of off the top of my head. I will try to check back in a few days if I can remember to.

[…] week we posted that it was possible to have authorized user cards removed from your credit report once you are no longer an aut… (i.e. because the primary cardholder closed the account entirely or simply cancelled your card). […]

I’m not clear from your article or replies, did you send the message to chase using your chase login information even though the card doesn’t show on your chase long? Or did you send it through your friend’s login where the card came from?

[…] to you, I thought it would be helpful to look at removing these accounts from your credit report (DEM Flyers has tackled this before, but not all card issuers were accounted for). Obviously this isn’t […]

Great post, thank you! I wish I had re-read this before I added my wife as an AU to my AMEX card. I was hoping it would back-date to 2005. It didn’t.

I would love to find out if anybody was able to remove the AMEX AU account from their credit scores.

Gonna use your letter – thanks for posting it!

J. Grant

PS. Keep the blog going! 🙂

[…] Did You Know? You Can Have Authorized User Cards Removed from Your Credit Report – If an authorized user account is affecting your score, then you may be able to get the account removed from your report some of the time. […]