I was doing some bookkeeping on Mint tonight, and I decided it would be both fun and educational to look at my travel expenses from last year and do an accounting.

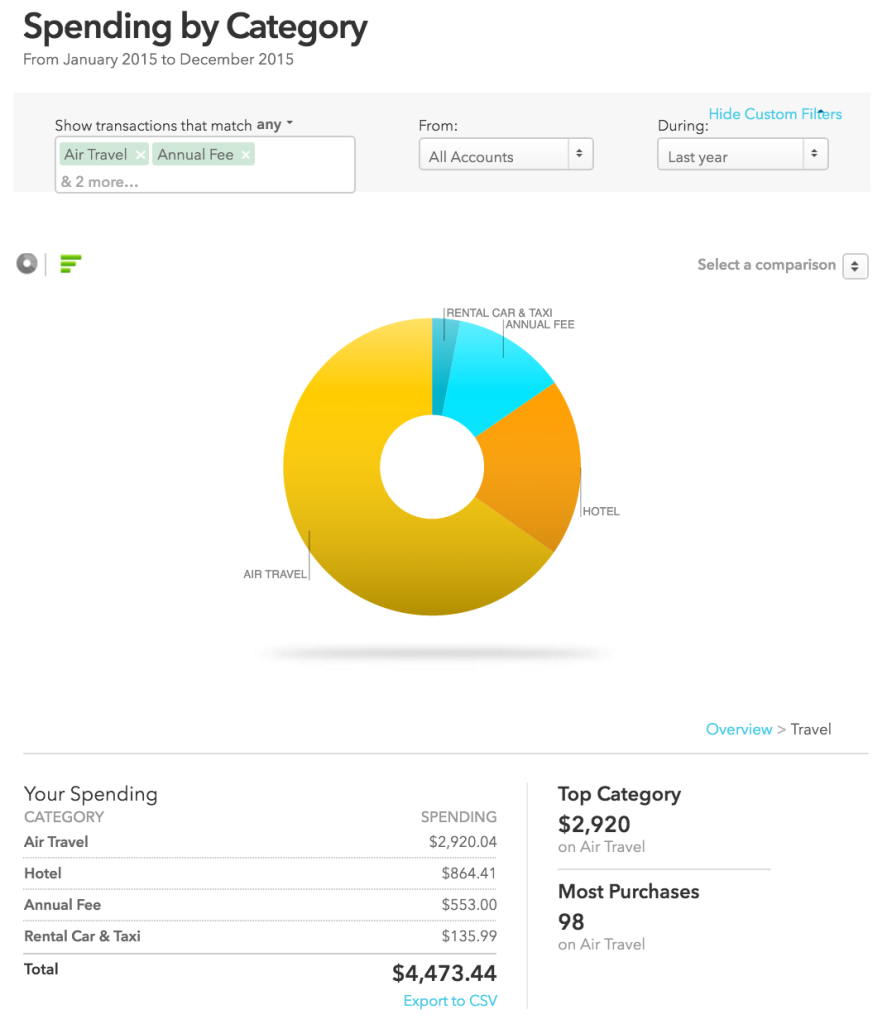

Let’s start with a graph:

$4,473. That’s a big number.

Granted, I got a ton of trips out of my $4,473 (Phoenix, India, Japan, Chicago, the U.S. Southwest, Bogota, Bali, Vegas, LA, and NY x 3), but it doesn’t change the fact that it’s still a lot of money.

Table of Contents

How do I justify it?

Given that 2015 was my first full year travel hacking, I feel this is within the realm of what I would have expected. Most of my airfares were paid (albeit mistake fares) because I hadn’t yet built up solid mileage balances (most of them were below 10,000 for the first half of the year). Fast forward to now, when I have about 500,000 airline miles and 200,000 hotel points, as well as three full trips (first class airfare and a few hotel nights) already paid for, and it’s easy to see my expenses going down.

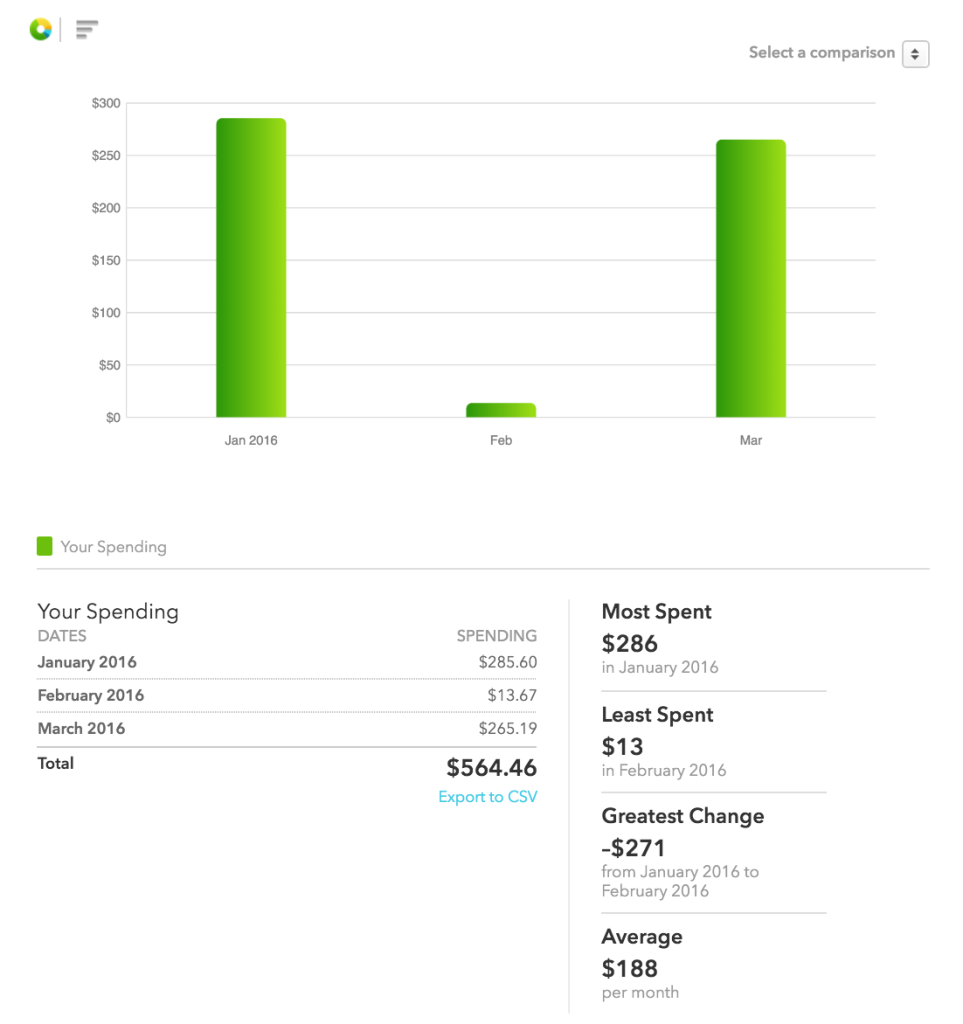

In fact, my first three months of expenses seem to support this hypothesis:

My guess is that if I look back a few years from now, this year (2016) will probably be a better representation of my stable-state than last year (2015) as I start to reap the benefits of my travel hacking (a hidden part of which is also some premium/luxury travel).

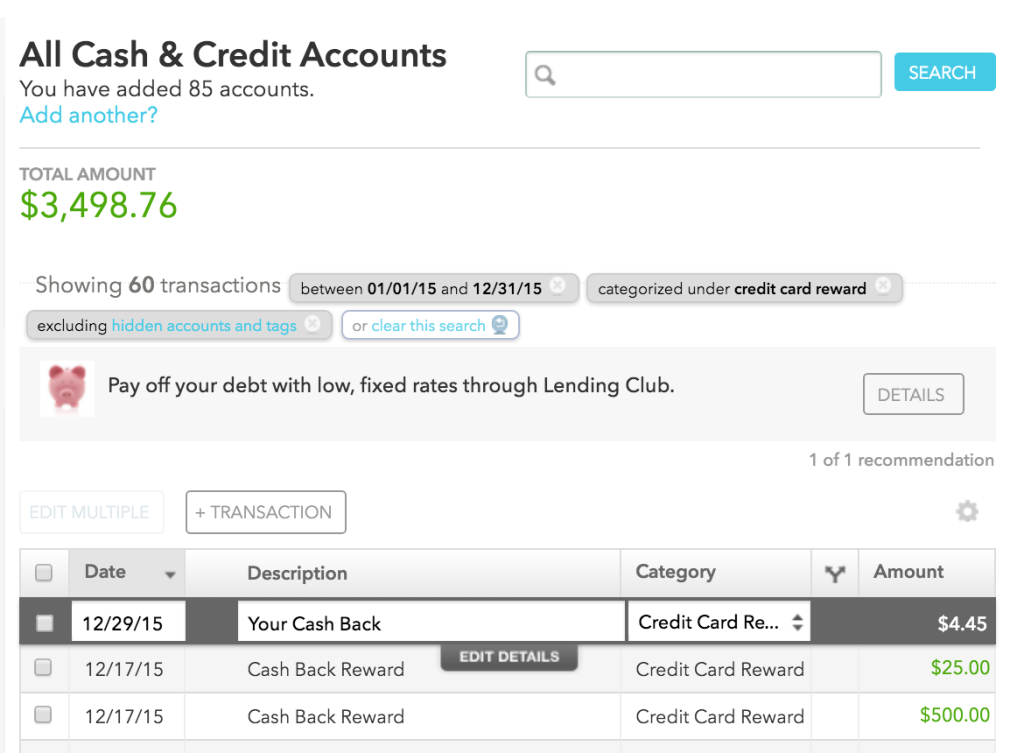

I also do something a bit differently than most in that any cash back I get from my credit cards (whether straight cash back or Venture “Miles” that I cash out), I count in a separate bucket external to travel. Why is that? Well, cash is cash. It’s fungible with all other cash. Therefore it doesn’t eliminate the fact that I spent money on travel. It offsets it, sure, but I can’t act as if the expense didn’t exist when I could have put the money in an investment account or bought a new computer (or two or three).

That said, here was my “haul” from last year, nearly all of which came from credit card signups and manufactured spending activity:

Not bad 😉

How do I compare?

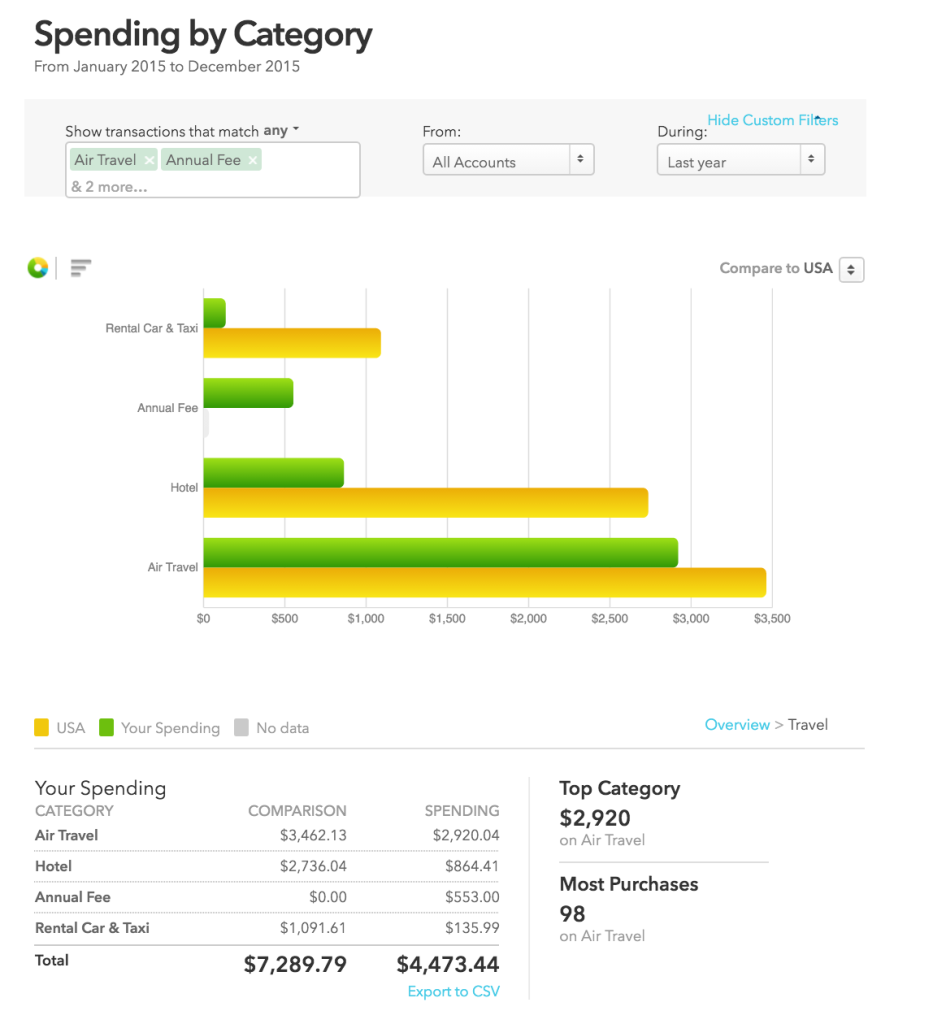

This is a tough one to answer, especially since people track their purchases and do their accounting differently (e.g. how to count cash back). However Mint has a feature to graph your spending against other demographics (geographic), so I gave it a shot:

My first reaction is that “Hey, I’m not doing too bad!” especially considering I think that my expenses last year were particularly bloated. In particular, I really won the hotel game, helped in large part due to the $1100 in Orbucks I racked up as well as a bunch of super lucrative promotions from IHG.

However, on second thought, I’m not so sure. Why? Presumably the metric includes people who manage expenses on behalf of themselves and a partner, or themselves, a partner, and their family. Of course they’ll have higher airfare expenditures than a solo traveler! Hotels are still a bit of a wash since the marginal cost per person is usually low, so I did well there, but even the “Rental Car & Taxi” category is a bit fuzzy because, although there is a separate, non-travel “Cab” category, Mint isn’t great at delineating between the two. So I suspect that expense is also lower than listed.

Moreover — and this is the more important point — there is almost certainly some sample skew. People who use Mint are more likely to have a computer, know how to use internet services, and think to do financial management in the first place. Simply, they’re more affluent than the average population and because of that don’t create a true “average” to compare against.

How can I do better?

This is the million-dollar (well, $4,473) question. I actually thought that hotel expenses would be the killer since I have far more hotel nights than I do flights, but it’s quite the opposite. Not only do hotels allow for more deal-hunting (since refundable hotel reservations are the norm rather than exception, unlike flights), but also I can split a hotel room with my friends. There is just such a wide range of amenities and offerings that it’s really simple to keep hotel expenses low without compromising on your experience.

That said, I think a good goal for me would be to inflate the quality of the hotels I stay at, while holding price constant. I have a surfeit of hotel points from having paid cash or Orbucks instead of points, so I should put them to use! I also have a better sense of the hotel landscape and some of the parts that are eminently hackable, so hopefully I can take advantage of my new found knowledge.

So what about the flights? My airfare expenses (whether real or opportunity cost or redeeming points) are basically going to be directly proportional to how many trips I take. The one room for improvement on the hacking side of things would be to take better advantage of routings to construct extra/hidden trips (i.e. better maximize the value of what I’m getting out of paid flights), but otherwise, I want to spend a bit more time looking locally. Maybe I’ll rent a car for a weekend instead of taking a plane somewhere. California (and the U.S., for that matter) has so much to offer, and I feel like I’ve taken so little advantage of living out here (outside the shorter flights to Asia and the Pacific).

In Conclusion

I titled this post “Keeping Myself Honest,” and I went into it without any particular idea of how I would achieve that. Eventually, I decided that the best I could do (as with many of my posts) was to let numbers speak for themselves, and I don’t think there’s a better way to have done that than by a (literal) public accounting. And so that’s what you have above.

Happy hacking!

[…] this post was in draft I saw an interesting pair of posts over at ‘dem flyers. In it Daniel outlines how he tried to calculate the amount he […]

[…] few weeks ago I wrote a post that looked at my travel spending in 2015 with the goal of “keeping myself honest,” and see if […]