Most of us know that shopping internationally can mean a significant savings especially with tax refunds via Global Blue, Planet Payment, Travelex, etc. I recently returned from Paris, where I shopped at a few stores who did tax refunds via Global Blue. However, I also discovered and tried out a newer service called Wevat (referral REQRESZQ for additional 5 euros refund; I receive no commission) for smaller purchases, and I’m here to report the experience!

Table of Contents

Benefits

While you still have to wait in line at the airport to process your refunds, the Wevat app makes it convenient to digitally track your shopping and expected refunds in one place.

- Easier to qualify: You don’t need to spend at least 100 euros in each store — you only need to spend 100 euros TOTAL across ALL stores during your trip.

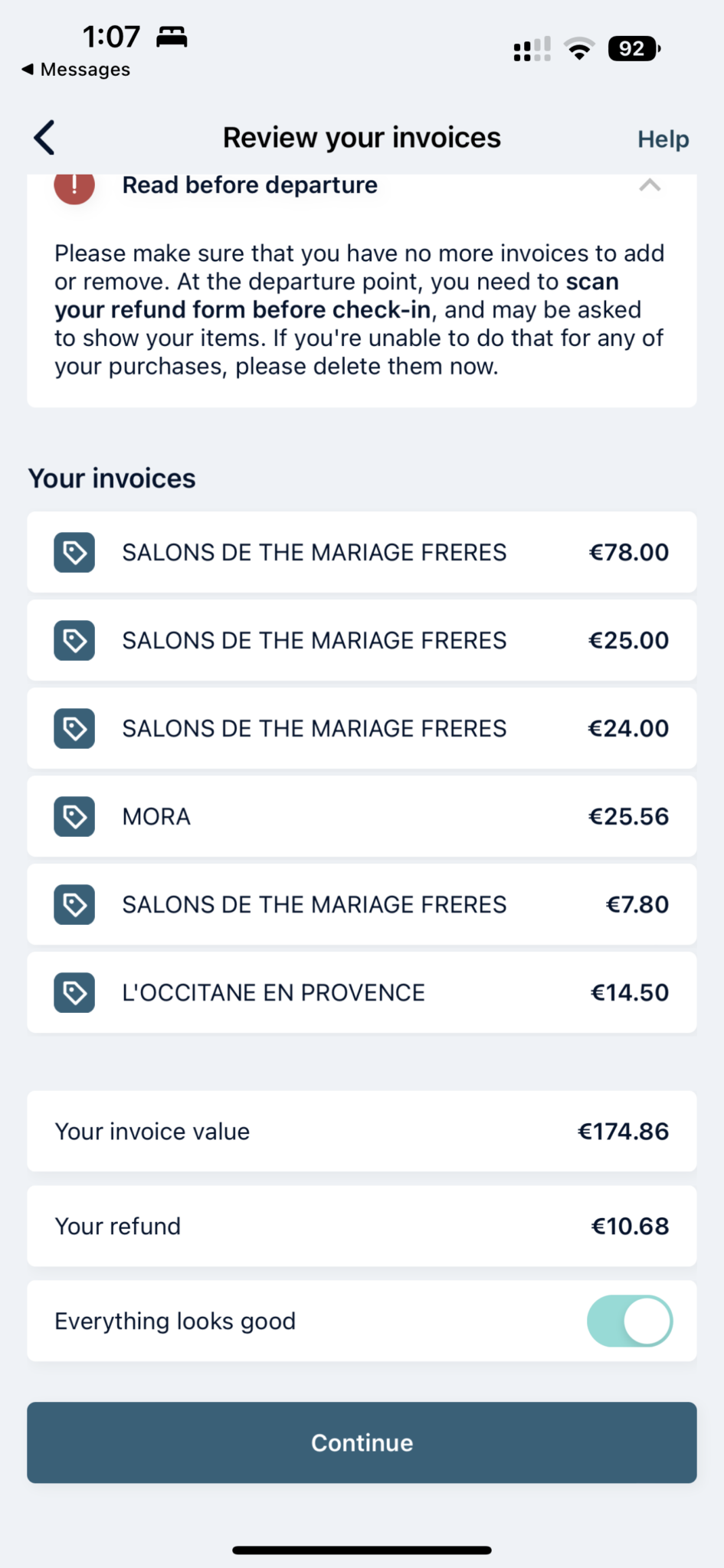

- More cashback: You’ll get a higher refund than you would if you allow stores to process traditional VAT refund paperwork via Global Blue, Planet Payment, etc — this is because Wevat has a single, transparent service fee of 22% and no foreign exchange fee. They take a smaller commission from your refund than the traditional providers do. With large luxury goods purchases, every percent makes a difference!

- Digital convenience: If you stay on top of taking photos of your factures (invoices), then you can easily track your progress towards the 100 euro minimum, and also your expected refund, anytime during your trip. Track your refund status in the app as well.

- No calculator needed: Even if you procrastinate on taking photos until the end, you can still quickly see your total expected refund without having to do math on all your paper invoices.

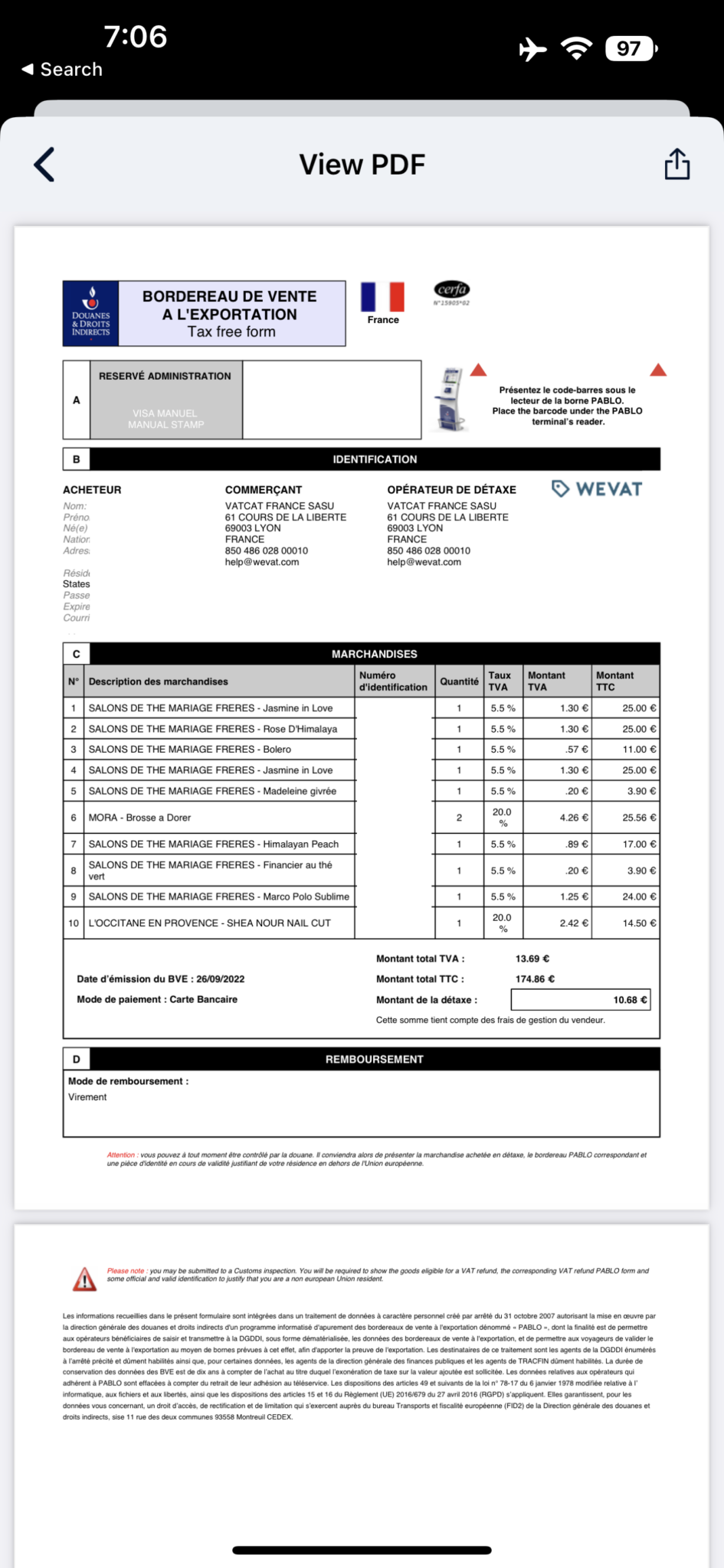

- No physical paperwork: You take photos of your invoices and your VAT paperwork is generated digitally, no printing required. Just scan the barcode at the kiosk in the airport.

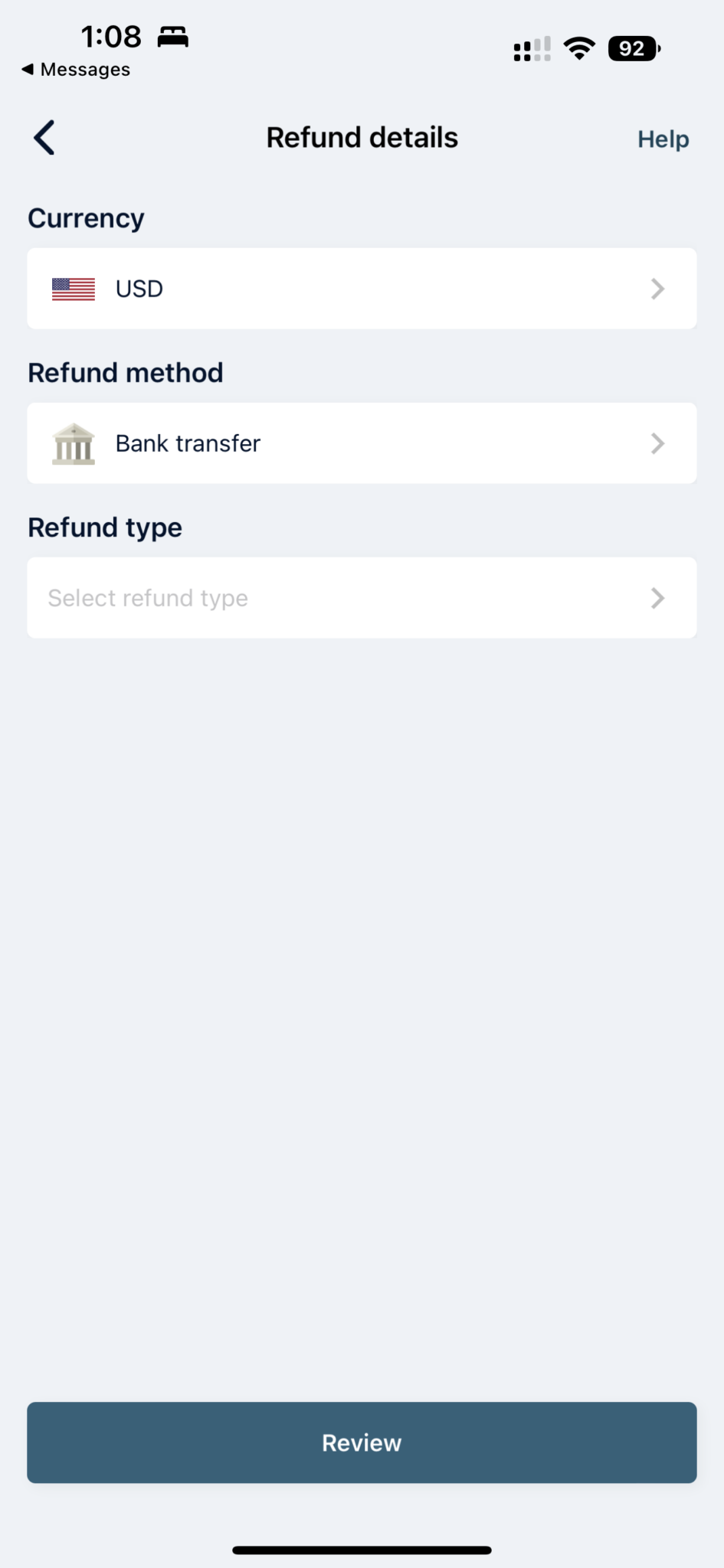

- More refund methods: You can get a refund by credit/debit card, ACH, Alipay, or WeChat Pay. Traditionally, you get a refund by credit/debit card or cash.

- Better support: Support from Wevat is conducted through chat, so no calling needed! They respond quickly as well.

- Works for ONLINE purchases too: Not only can you get a VAT refund for in-store purchases, you can also get a refund for online purchases, and it’s actually easier. You can shop before you even arrive in France and do delivery or pickup. Shopping online means you could use cashback portals to get even more money back!

Experience

Step 1: Sign up and enter your trip dates

Sign up in the Wevat app. Follow the instructions to enter your trip dates and point of departure to ensure it’s a supported exit point. If you use my referral code REQRESZQ, you’ll get an extra €5 back if you spend over €500. Pretty small beans, and there’s no benefit to me (I don’t get another €5 or anything), but no harm in adding it to your account if there’s a chance you might spend that much.

Step 2: SHOP!! & request a facture

Shop for qualifying goods. Generally most items purchased in France qualify as long as they are for personal use and taken with you (i.e. not consumed within France). Check the FAQ for more details.

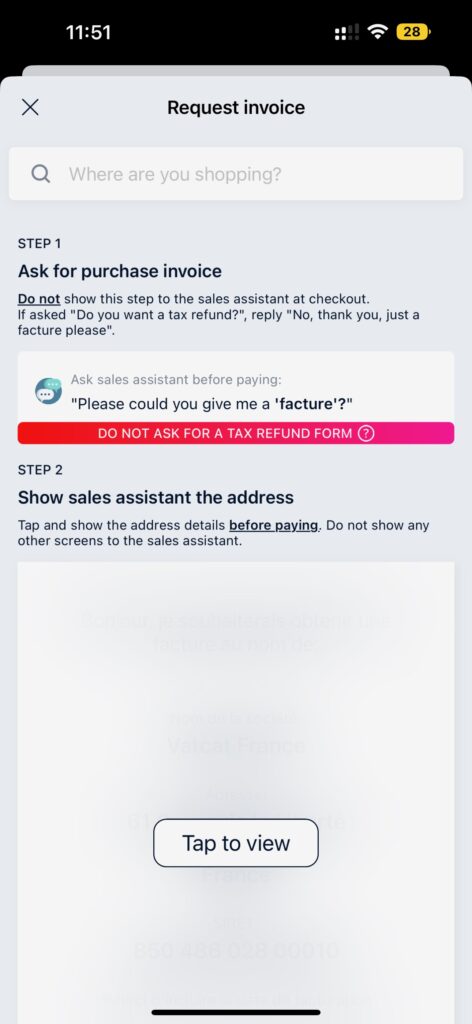

When paying for your items in-person, you’ll need to request a facture/invoice. I think Wevat is popular enough in Paris that most clerks have heard of it before and done it. They may do it in different ways. The app tells you how to request for this document, along with a screen to show the clerk which has the instructions in French.

Note that the instructions say to reject a traditional tax refund form. If you claim a tax refund through Global Blue or Planet Payment, you will NOT be eligible to claim a tax refund with Wevat. No double dipping! Go with Wevat if it’s a large purchase, since you’ll get at least a percent more back, if not more. If it’s just a 100 euro purchase, then it’s not going to make a huge difference, and you’ll get your refund back faster with the traditional companies depending on the refund method (cash is the fastest, then credit/debit card; mail-in forms are the slowest).

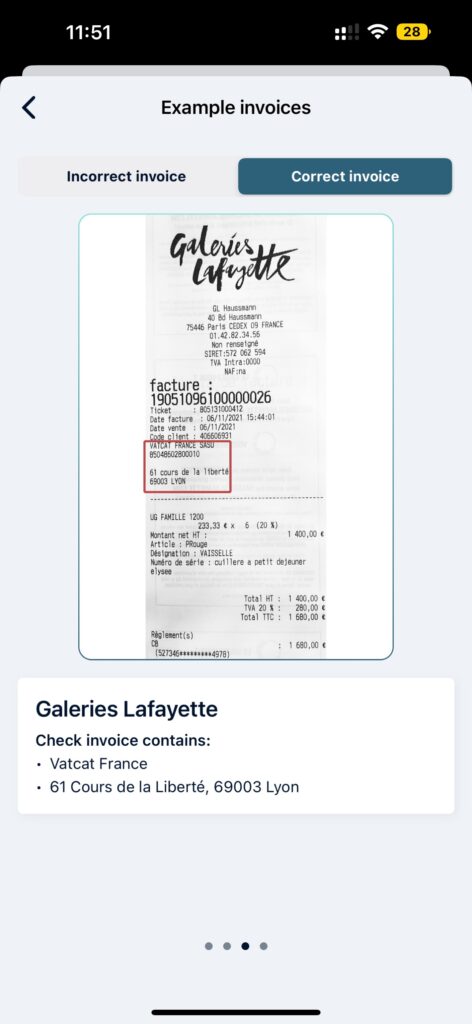

The most important thing is that “Vatcat France” is on the receipt SOMEWHERE. L’Occitane was able to add it to the receipt for me. Mariage Freres (the tea shop) wanted to generate a Word document and print it on A4 paper. Clearly, L’Occitane’s method is faster (seconds vs. minutes), but every store has their own policies. FWIW, I discovered Vatcat halfway through my trip, but I was able to return to the stores I had shopped at the prior days to request a reprint of the receipts with Vatcat France printed on them! French people are so kind. 🥰

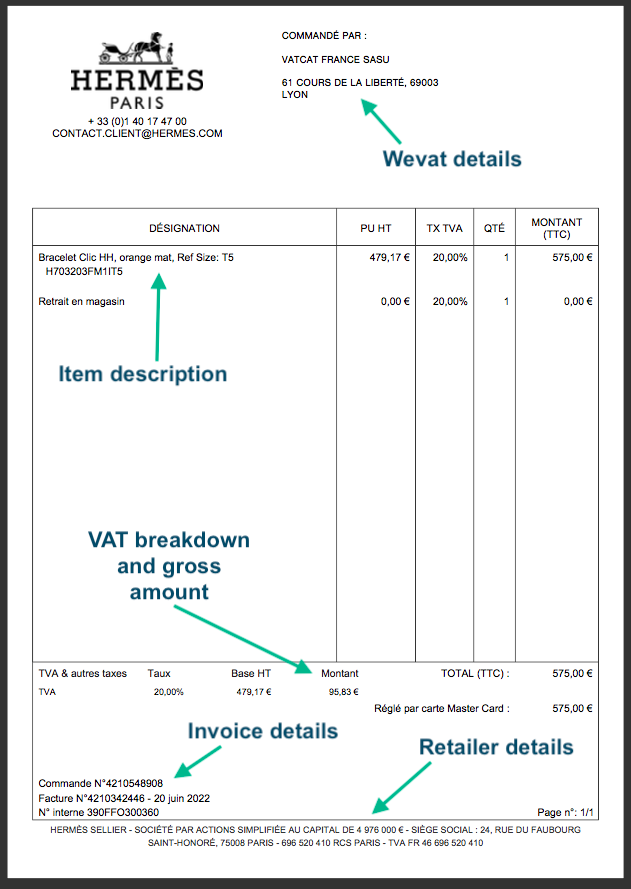

If you shop online, just enter Vatcat’s info under the billing address section. Follow these instructions for details. Shopping online and obtaining a qualifying facture is virtually pain-free and far easier than in-store, which depends on store personnel knowing how to get Vatcat’s name onto the receipt.

Step 3: Upload invoices

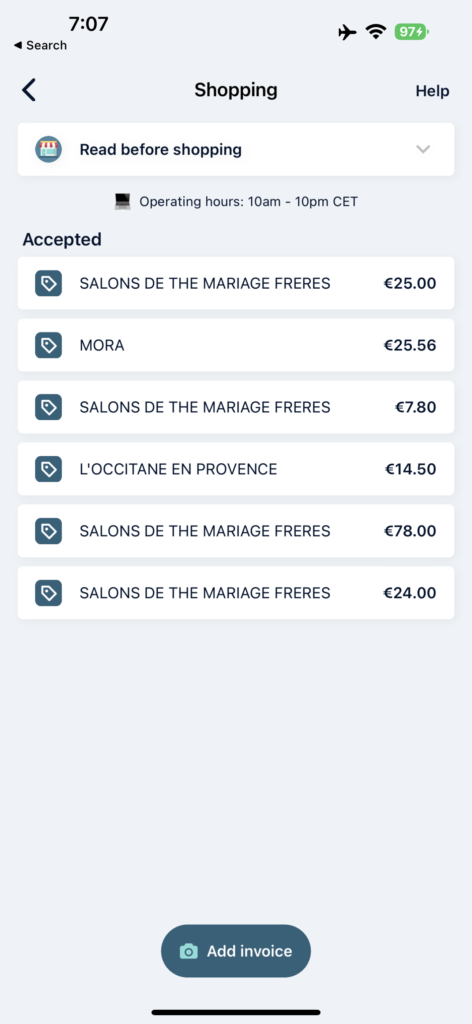

Use the app to take photos of all those factures you obtained. They need to be approved by Wevat staff, so don’t procrastinate. Just do it when you get outside the store! In my experience they were all approved within 15 minutes, but could take up to a few hours.

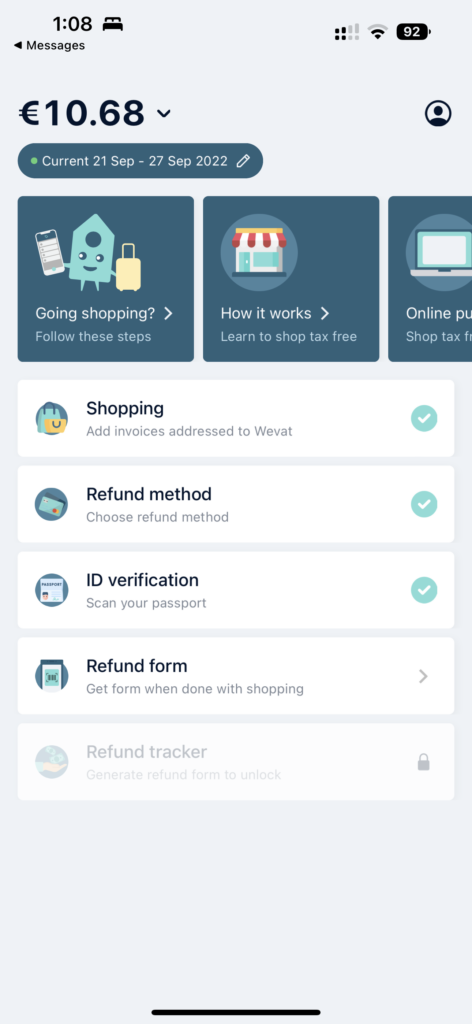

Track your total expected refund anytime on the homepage (top left).

Step 4: Generate form prior to departure

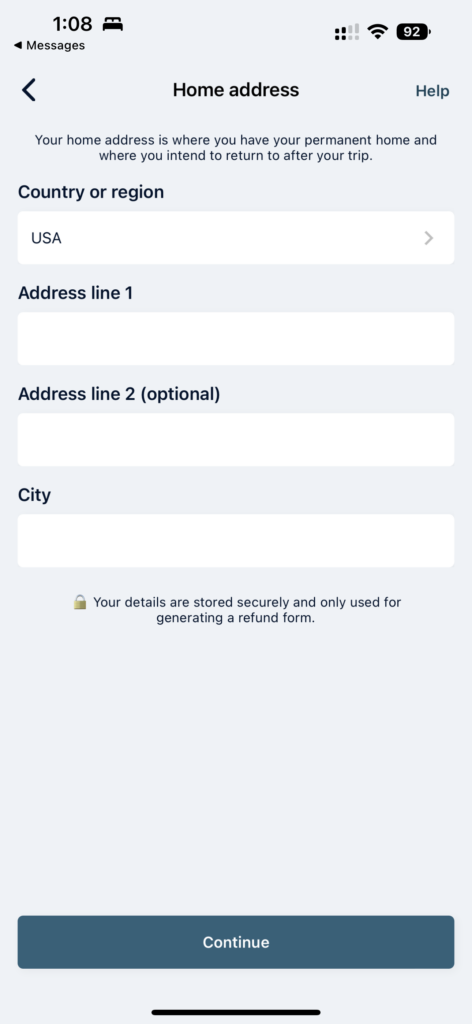

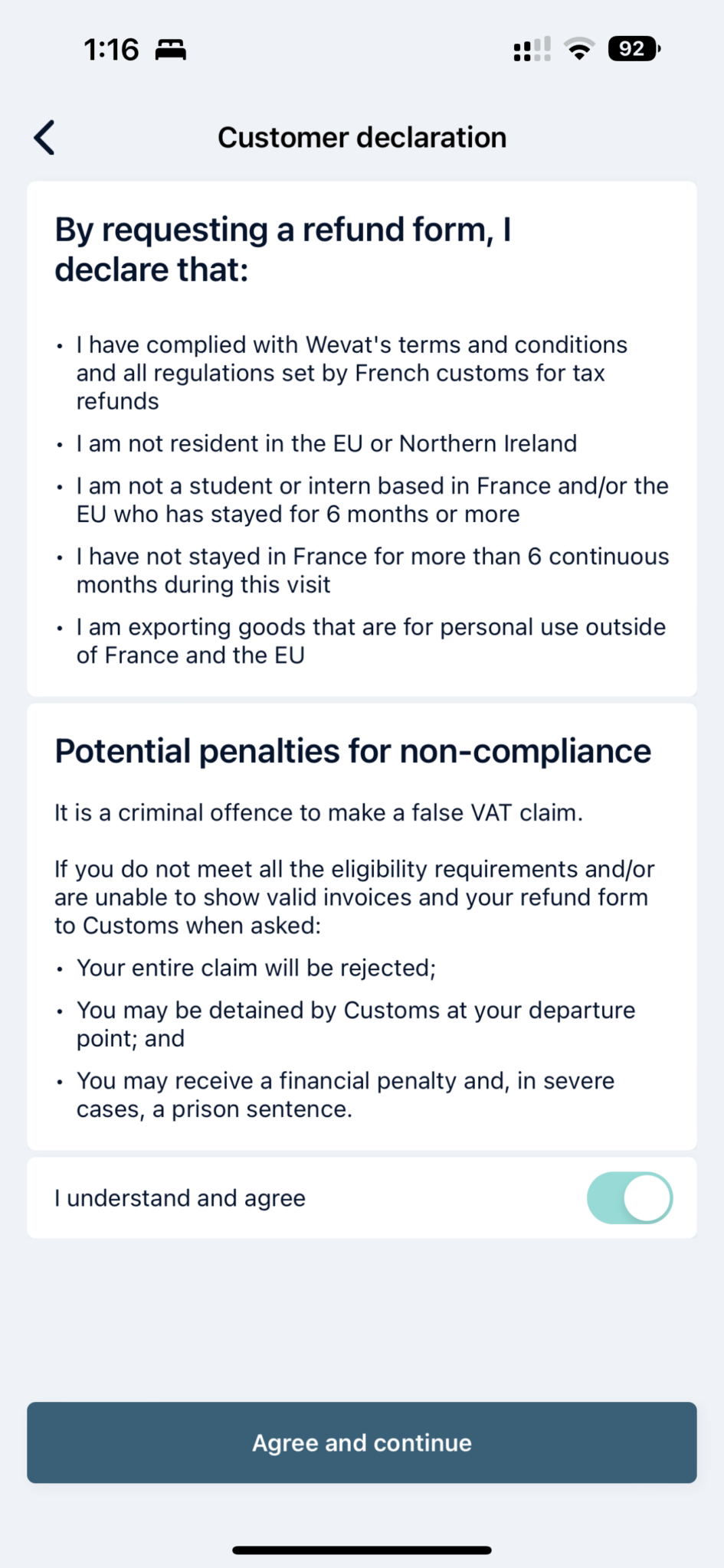

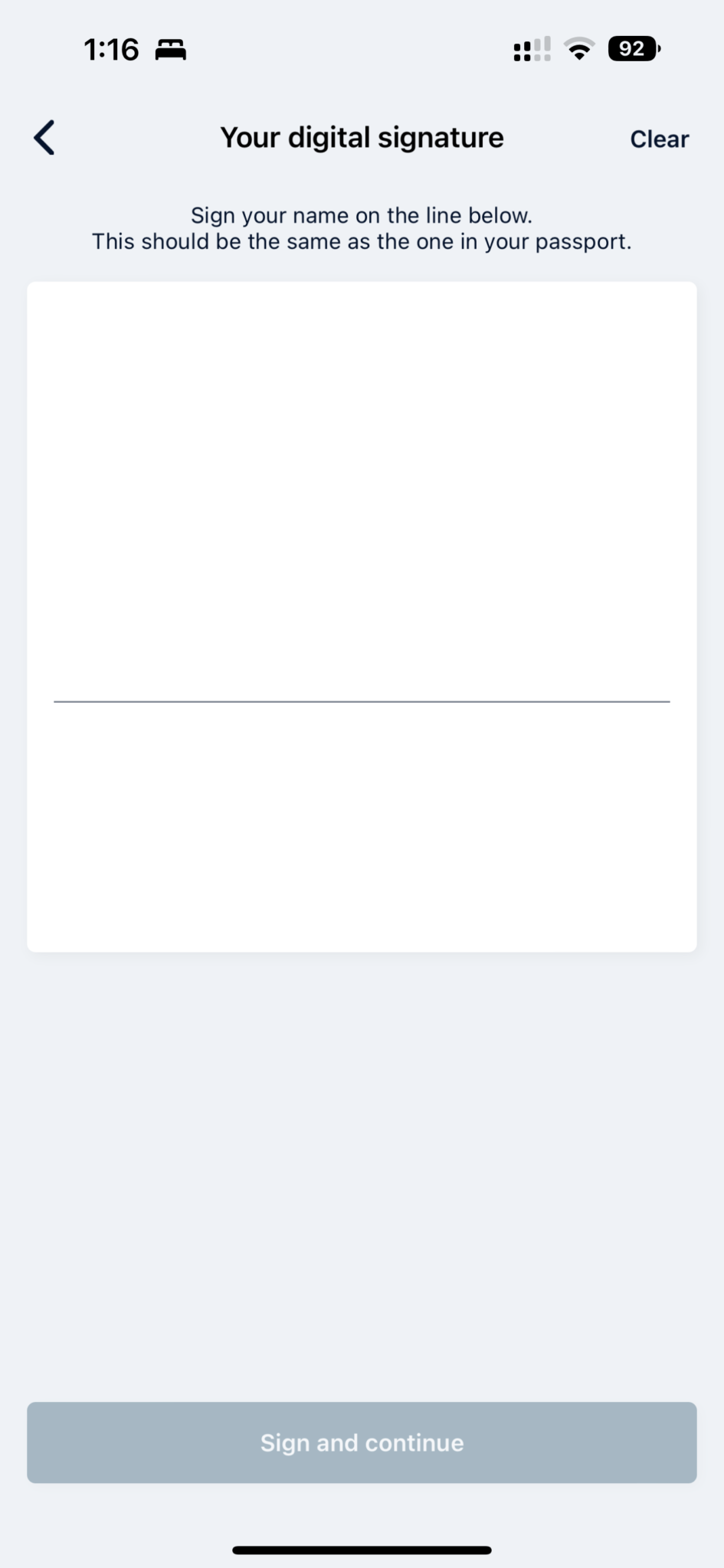

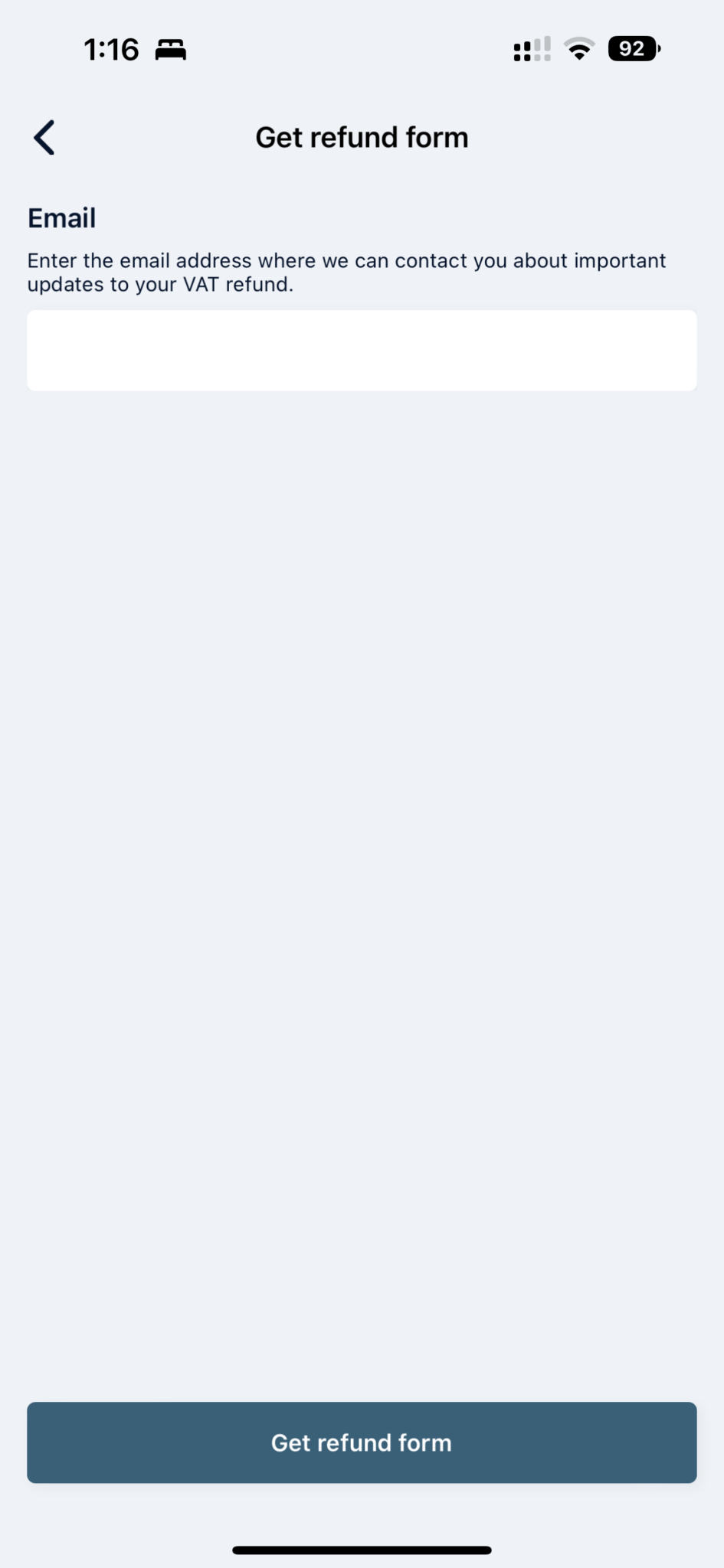

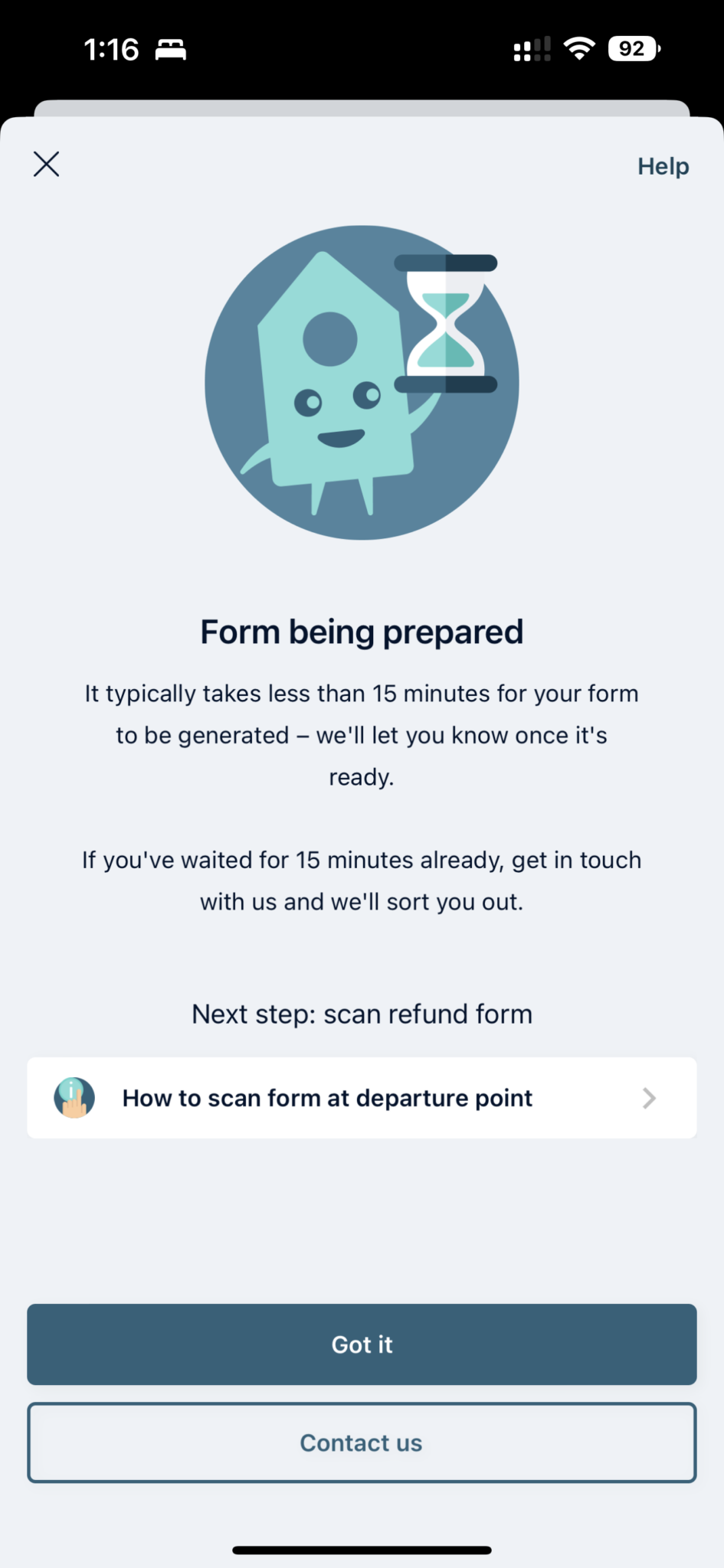

You’ll need the tax refund form before you leave, so do this the day before departure since this form can take a few hours to generate. First, you’ll enter your desired refund method (credit/debit card, ACH, WeChat, Alipay). Then, you verify your identity by scanning your passport and taking a live selfie. Verify all your receipts have been uploaded and then request the form.

Step 5: Scan barcode and receive refund

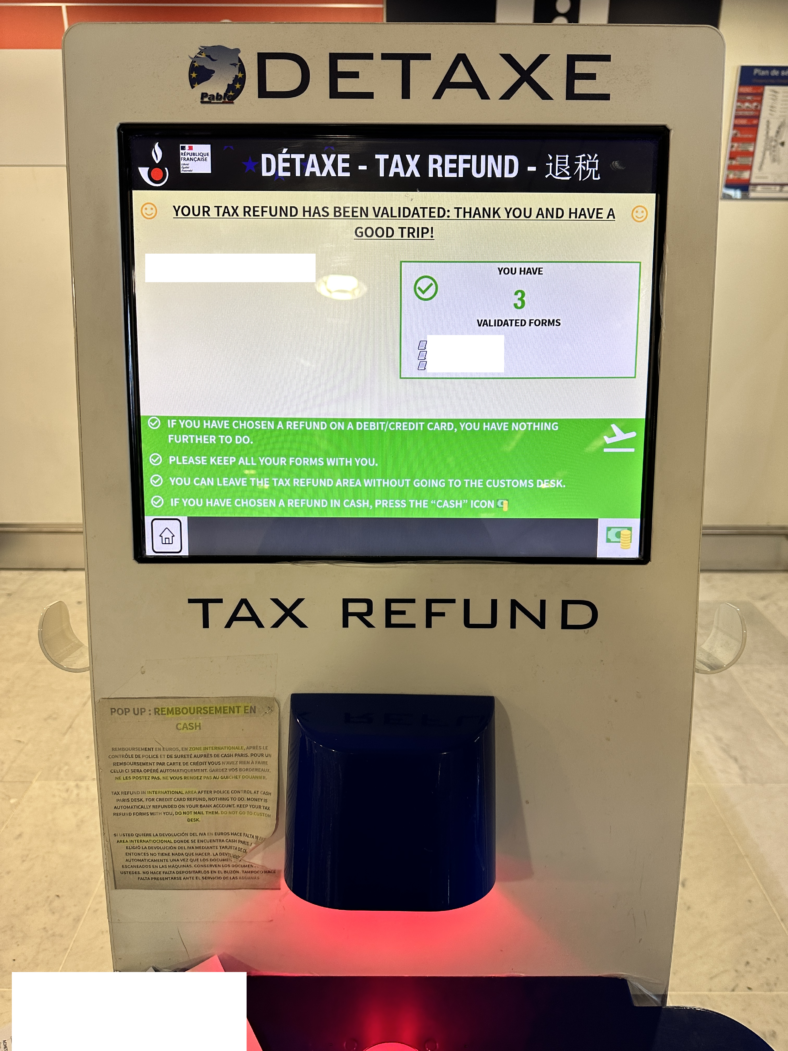

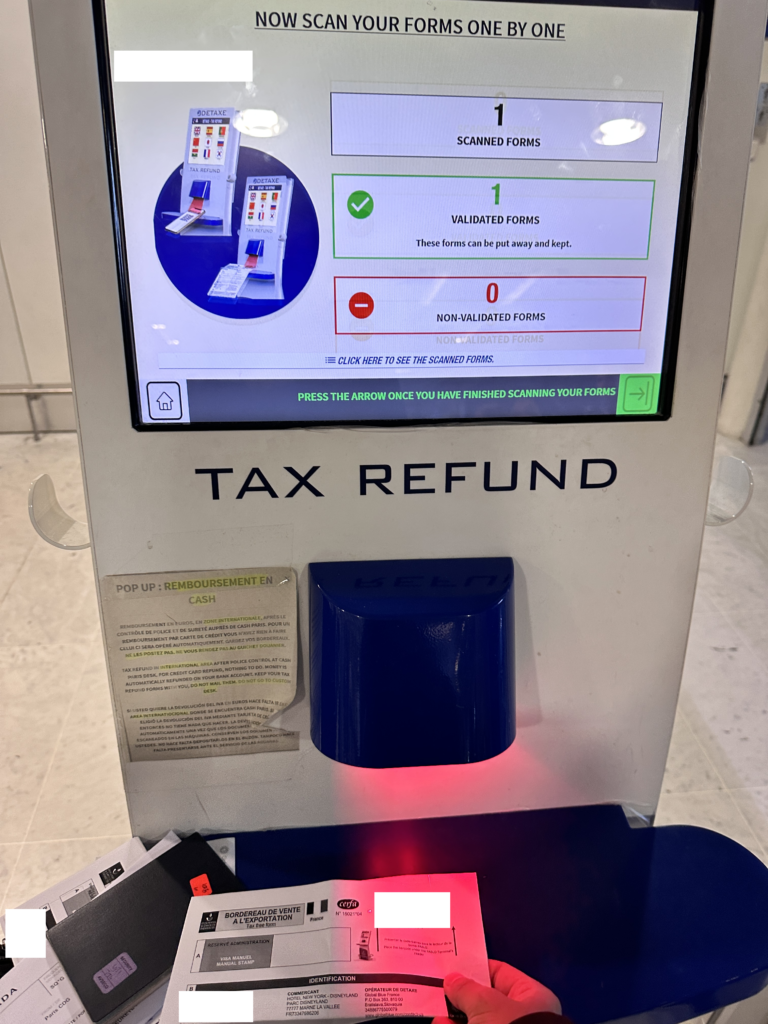

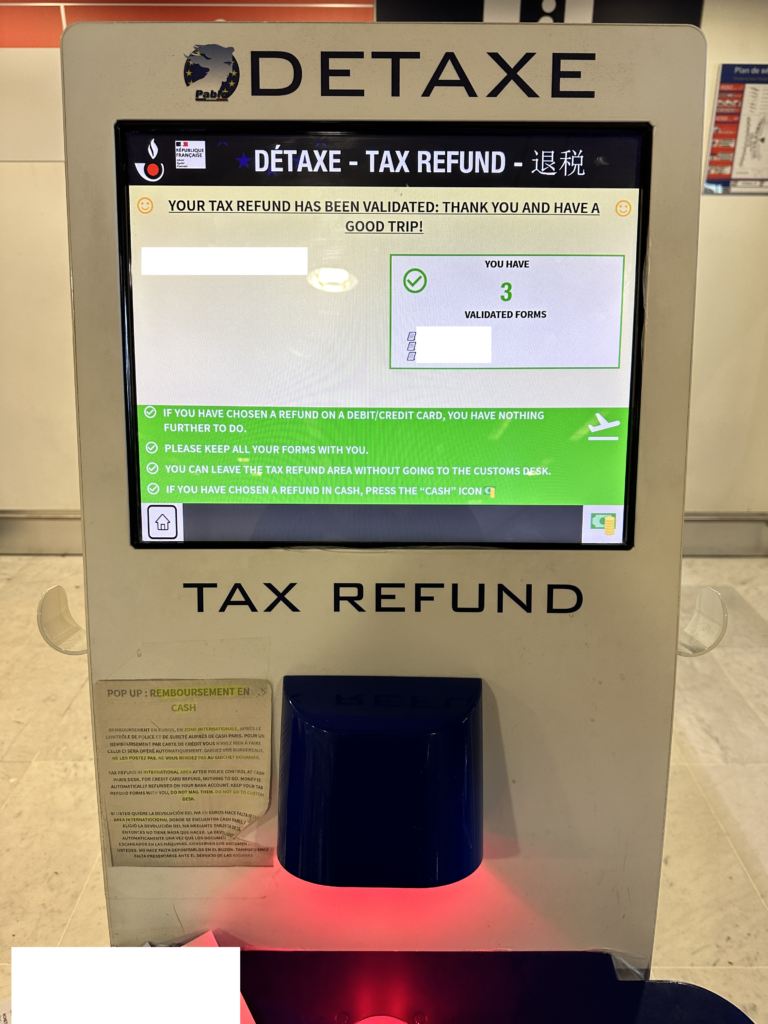

When you get to the airport, find the PABLO détaxe kiosks in your terminal (pre-security). There was a long line at the one I went to, but it went quickly since there were many kiosks and they’re all self-service (no need to talk to anyone).

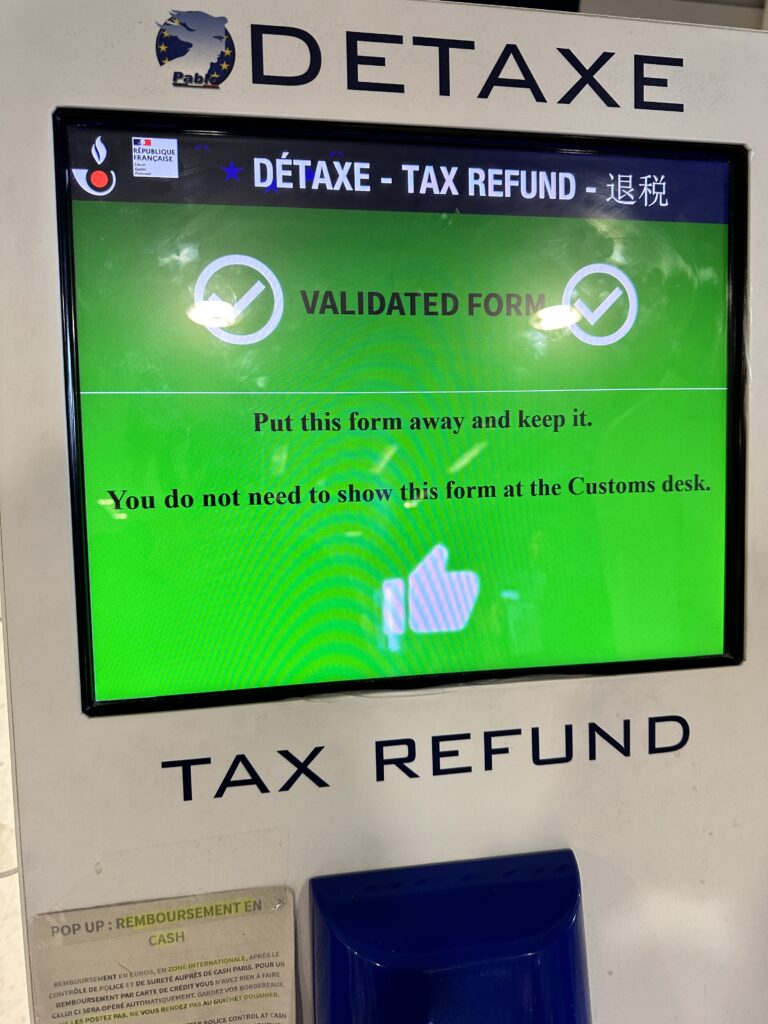

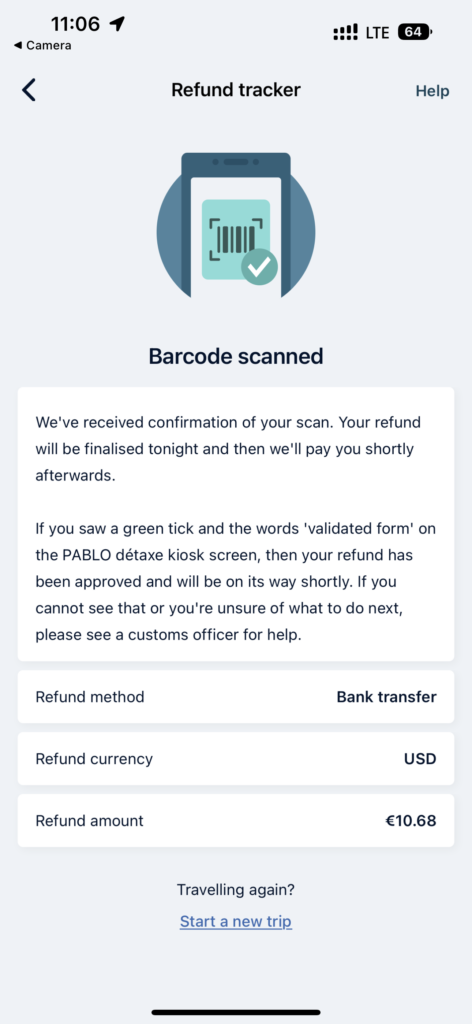

Scan the barcode from your app (in addition to the PDF form, they also include an image of a barcode that takes up the whole screen for easier scanning). The machine should display a green checkmark, and you’re good to go! Within a couple months, you will receive your refund in your selected currency and refund method.

Conclusion

Overall, I would recommend the Wevat app. Requesting a facture for small purchases was a little annoying at some places, but for the most part it wasn’t an issue for the sales clerks. The refund is also slower than the traditional method, although I heard that the mail-in form refunds are also taking months, so I guess this is in the same boat. The things I loved most about Wevat was how convenient it was to quickly track everything in one dashboard, and be able to get a higher refund and not have to spend 100 euros at EACH store. The app is also quite user-friendly, in my opinion.

Hope this was a helpful overview on how to save more on shopping in France with the convenient Wevat app!