UPDATE: if you used our referral links, could you please let us know? Apparently the referrals are not getting automatically tracked.

Hello everyone!

I’ve been getting bombarded for over a year by FoundersCard (referral link, see end of post for details) to join their program at a lifetime rate of $295/year. That wasn’t very appealing to me at the time, since I couldn’t justify how to get more than $295/year of value from the program. My friends Kenneth and Tonei were telling me about some of the great benefits. I’m going to rank them here as well as a few thoughts:

Table of Contents

Most Valuable Benefits to Me

| Total Rewards Diamond status | This can be a great benefit for some people for the following reasons:

I go to Vegas once a year for CES (the largest convention in the world and the most expensive week in Vegas), and already have MLife Platinum status from the Hyatt Diamond match. It wasn’t clear to me whether having this status would significantly benefit me during my annual trips, since I already have Platinum status from the Total Rewards credit card, and haven’t really benefited from it in terms of getting hotel discounts. However, that complimentary stay in the Bahamas sounds pretty sweet!! |

| First Republic Bank $350 offer |

Only applies to New York City, Boston, Greater San Francisco Bay Area, Los Angeles, Portland, Santa Barbara, San Diego, and Newport Beach. If you’re in one of these locations, this is a very valuable benefit. Kenneth tells me they have very personalized and awesome customer service too. |

| Quarterly American Airlines promotions | Currently, there is a Business ExtrAA bonus points program, which might be interesting. Sometimes there are challenges to AA status. I think it will be worth keeping an eye on these quarterly AA promos. |

Other popular benefits I’d like to point out

| 15% off AT&T Plans | I’m on T-Mobile, but I also get 25% corporate discounts on all 3 major carriers, and I don’t think it stacks. If you don’t already have a corporate discount, this might be helpful to you. If you have a family plan or expensive plan, this could really be a huge savings. |

| Discounted hotel rates | I usually use points to pay for hotels, or if it’s for work, they must be booked through our Concur system anyways, so I wouldn’t be able to apply any discounts. Many of the hotels are luxury hotels that I still can’t afford even with a discount anyways. But if you want to stay in a luxury hotel for a discount, this one’s for you. For example, if you want to book the Park Hyatt Tokyo, it is 40,000 yen/night, and you’d be able to apply a DSU if you’re Hyatt Diamond. |

| 15% off HotelTonight | Same reasoning as above. |

| Cathay Pacific Marco Polo Silver status and 5-25% off flights | This translates to Oneworld Ruby status. I’m not sure how this would benefit my husband or I in the near future, and we are currently already AA Platinum (Oneworld Sapphire) from the Q4 status challenge. The 5-25% discount could potentially be a large savings though. |

| Virgin Atlantic Flying Club Silver status | Earn 50% more miles when flying Virgin Atlantic or Delta Airlines, lounge access, premium check-in, and choosing Economy seats within 14 days of departure. Not really something I see myself using in the near future. |

| 5-10% off Virgin America flights and Gold or Silver status match | This discount code is valid on most fares except for L, S, and N fares. However, I already have VX Silver status (partly thanks to the VX credit card) and while they are my favorite domestic airline, I don’t fly VX quite enough to really benefit from this discount. |

| 5% off Jetblue flights | I like Jetblue, but I rarely have the occasion to fly them. Being a budget airline, 5% is probably not going to be a huge savings. If you fly Jetblue a lot though, it can add up. |

| 15% off Qantas flights to AU/NZ only | 15% is a great discount, but I rarely fly Qantas either (to tell the truth, I’ve never flown Qantas before). If I saw an awesome fare deal in economy, I’d consider jumping on it and using this discount, but the next time I go to AU/NZ, I’d more likely fly in a premium class with miles and points! |

| 1 year of TripIt Pro, $39/yr after | I personally have Lifetime Pro, but this could be useful to many people, especially if they don’t already have it from a credit card or from their workplace. |

| 6 months of CLEAR | CLEAR is definitely a nice-to-have, but it’s not available in most airports, and sometimes even at my home airport (SFO), the CLEAR line is not any faster than the TSA Precheck line. I already pay $50/year for my CLEAR membership, but don’t consider it must-have. |

| 20% off Silvercar | I love Silvercar cars (Audi A4s!), but they’re not at enough airports to be useful to me, and this is definitely a luxury, since even with the 20% off, it would be difficult to beat other rental car prices, especially when you use status and corporate codes, etc with the other companies. |

| 50% off OneMedical membership | This one is hyperlocal, but OneMedical is a great company that I hope will grow quickly throughout the country. Currently, I am choosing not to be a member yet because there aren’t enough locations that are convenient to me. |

| $18 to Dollar Shave Club and free shipping | Michael Wu noticed this one. They sell things other than razors too. 🙂 |

| 3 years free Dashlane Premium | This is a secure password keeper and digital wallet. I highly recommend using one, but I currently have a paid subscription to 1Password that works great for me. |

| 20% off Backblaze | This is a great unlimited cloud backup solution, and again, I highly recommend using one. A year is $50 (the discount would provide $10 savings) and 2 years is $95 (the discount would provide $19 savings). I currently have a paid subscription to Crashplan, which is great, and the minor savings is not quite enough to incentivize me to upload terabytes of my files all over again. |

| $100 to Trunk Club | This is a subscription service where they basically send you a box of fashionable clothes. $100 seems like a good incentive to try it out. |

| $35 Zipcar membership and $20 towards first drive | For those without cars, this may be a nice benefit. I do have a car and otherwise I use rideshare services. |

| Up to 14% off Singapore Airlines flights, 5-10% off Emirates flights | Both of these discounts could potentially be good for many people. For me personally, I’m most likely not going to be flying these airlines on cash fares, but using miles and points in premium classes. |

| Up to 36% off UPS shipments | From my limited experience, the discounts eBay/Paypal provides on shipping labels purchased through them are comparable. There could be sweet spots though. |

Benefits That Are Already Attainable Elsewhere

| Car rental company status and discounts | If you have a World Elite Mastercard (i.e. Barclay Arrivals+), you would have Avis, National, Sixt, and Hertz status already. You probably have access to a bunch of discounts already too, or know where to get them. 😉 |

| Hilton Gold status | This is a benefit that is already conferred by the Amex Platinum card, but my husband and I are already both Hilton Diamond thanks to status matching to Hyatt. |

Other Benefits

- Discounts on Herman Miller chairs, Audi purchases/leases, BMW purchases, Apple, Dell, Moo business cards, Namecheap domain name hosting/services, Cole Haan, Spafinder, Shopify, Upwork, 99designs, LegalZoom, Constant Contact, Equinox, SoulCycle, Fancy Hands, 1-800-Flowers, Teleflora, Indochino, Rent the Runway, Adidas, Reebok, and more. A good question would be whether these discounts are stackable with our usual methods of hacking together discounts via portals, gift cards, codes, etc.

- Invitations to networking events

- You can also refer another person (intended for a spouse or significant other) who can then join for $395 one-time only rate (i.e. they don’t have to pay yearly like you do). I heard this used to be free, but no longer. Update: if you refer 5 people, you get a free membership for a significant other.

As you can see, most of the benefits are nice, but not impressive or convincing enough to sign up for a membership. Many of the discounts are for luxuries that I still would not even want to pay for even with a discount, but maybe my husband and I are just a lot more frugal than most entrepreneurs.

However, I pulled the trigger and signed up (for my husband).

Why? Because they finally hooked me with this email (as a gift card junkie, any email that has the word “gift card” in the title will catch my attention, lol):

Receive a $100 American Express Gift Card when you become a Member. Select one of the following offers by the end of May: • $295 Annual Rate when you prepay 2 years.

PROMO CODE: 100AMEX2YR

Savings of 50% off the standard rate, PLUS your rate is locked

in at $295 for life• $395 Annual Rate.

PROMO CODE: 100AMEX1YR

Savings of 33% off the standard rateOr you can use these codes to waive the $95 initiation fee:• $395 annual rate, promo code: VIP1YEAR

• $295 annual rate (two years upfront), promo code: VIP2YEAR

These codes expire 5/31 (but don’t worry, they’ll always try to hook you with new promos).

I used Kenneth’s referral link to give him some points, and I prepaid for 2 years. As a result, I paid $685 up front (used AT&T More to see if I would get 3X TYP…update: IT DID COUNT AS 3X TYP! woohoo!), I’ll get $100 back as an Amex Gift Card, and then I’ll do the First Republic Bank bonus for $350. That brings 2 years down to $235, which is a LOT more palatable to me.

It’s a little complicated if you want to use someone’s referral link to help them out, and still be able to use your own promo code. Here’s how to do it:

- Use your friend’s link (here’s ours) to register your interest in the program.

- Within a day (faster if during business hours), you’ll receive an email from with an invitation to apply, along with 2 codes FCVIP395 and FCVIP295. Click the link from the email to get to the application, and you’ll see that they prefilled that code for you. Change the codes to waive the $95 initiation fee (VIP1YEAR/VIP2YEAR), or get a $100 Amex GC back (100AMEX1YR/100AMEX2YR).

- Within another day, you should receive the approval of membership and can log in and refer others! 🙂

- Please let us know if you used our links!

I know it’s slightly more involved, but Michael and I would appreciate it if you use one of our links! 🙂

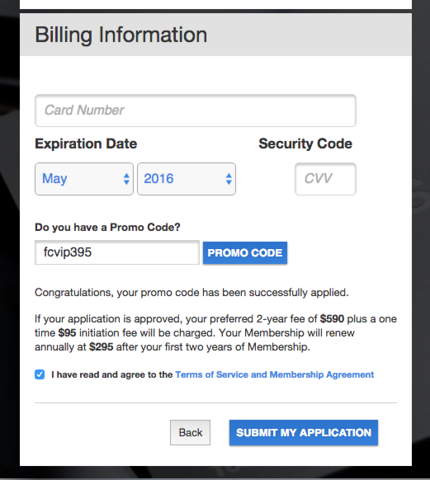

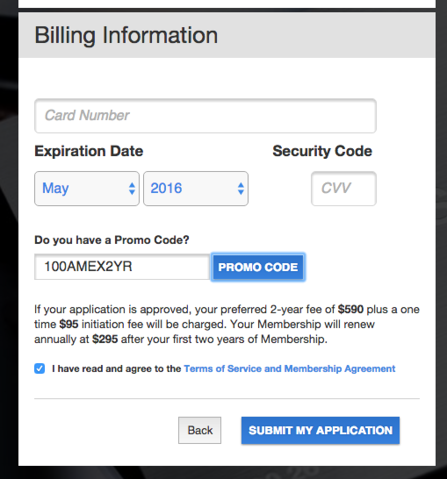

Here are a couple screenshots to show the second page of the application where you need to change the code:

When you first click the link to apply, you’ll see their recommended code applied. Change this code if you want a better deal!

Code changed to 100AMEX2YR. Still get $295/yr locked in, but now you also get a $100 Amex Gift Card.

Hope this post helps you decide whether this deal is for you! Now to go figure out how to overcome the rest of the $235 I paid… 🙂

If you’re already an FC Member, what hooked you in? What’s your favorite benefit? Comment below!

[…] Founderscard coded as 3X TYP! […]

[…] Caesar’s Palace, the LINQ, the Cromwell, Rio, Paris, and more. Specifically, I heard that Diamond status, which you can get through a match with FoundersCard had a lot of great benefits, like waived resort fees, buffet privileges and more (possibly even a […]

[…] you’re a member of Founderscard, you get free $18 there so this should […]

[…] ‘Dem Flyers posted about a new version of the $295 offer that also gives a $100 American Express gift card. That offer still requires a two year commitment, but that post highlighted something that I knew about, but didn’t really put together. One of the obscure benefits of FoundersCard membership is a $350 checking account bonus at First Republic Bank. (CA, OR, NY, MA, CT, FL only.) […]

[…] Dollar Shave purchases which will be $3 in our example below. (HT: AM) And if you’re a member of FoundersCard, you get free $18 there so this should […]